Actionable strategies for addressing operational and fiscal compliance with H.R. 1

State Medicaid programs are making efforts to be proactive as they navigate the far-reaching implications of H.R. 1. This federal legislation introduces significant changes that demand measured planning and a strategic response. From the introduction of community engagement provisions, and the complexities of 6-month renewal requirements, to reductions in federal healthcare funding, Medicaid leaders must balance compliance with operational efficiency. This balancing act must occur in tandem with the prioritization of service delivery to vulnerable populations.

This article will explore 3 of the most significant changes stemming from H.R. 1, while also reviewing insights and strategies that will help state Medicaid programs to adapt effectively.

-

Medicaid community engagement provisions are a balancing act

This change will affect approximately 50% of Medicaid recipients, creating operational challenges for state agencies. The H.R. 1 community engagement provisions require able-bodied adults ages 19–64 to meet work or activity requirements to maintain Medicaid eligibility.

States can lay the groundwork to address these provisions with 5 key considerations.

- Capacity planning: Anticipating and addressing workload increases will be critical as states assess the impact on intake and ongoing caseloads, appeals, eligibility churn, and call center volumes.

- Program design: By developing a structure for employment and training activities that can be self-directed or supervised, a proactive framework of job search materials, participant guides, and referral strategies is constructed.

- Policy alignment: Clear definitions of activities that meet community engagement requirements will be essential. States should seek consistency with other work-related programs, such as the Supplemental Nutrition Assistance Program (SNAP), to streamline processes and reduce confusion.

- Technology solutions: Implementing tools for tracking, validating, and monitoring activity hours will be critical. States should explore automation and system interfaces with workforce programs to minimize manual work and ensure compliance with federal reporting requirements.

- Partnerships: States can leverage partnerships with workforce agencies, community-based organizations, and other programs like SNAP and Temporary Assistance for Needy Families (TANF) to integrate services and reduce redundancy.

The success of these community engagement provisions will depend on a state's ability to balance compliance with revised federal requirements. States must also confront the operational realities of the existing systems serving their Medicaid population.

-

Six-month renewal requirements ushers in an era of operational complexity

One of the most impactful changes under H.R. 1 is the shift from annual to 6-month Medicaid renewal requirements for many cases. This change doubles the annual workload for the eligibility staff handling these cases, which mirrors the challenges faced during Medicaid Unwinding—a continuous enrollment condition that ended with the COVID-19 pandemic—but on a permanent basis.

Applying eligibility data from verified external sources can alleviate some effort, but managing the new work requirements at each renewal further complicates case review. States can help eligibility staff get ahead of these renewal requirements with some strategic actions.

- Workforce capacity: Investments in staffing solutions, training programs, process streamlining, and automation to handle the increased workload will help ease staff burdens.

- Renewal processes: Simplifying renewal processes and leveraging data sources like SNAP Semi-Annual Reporting can reduce the need for manual intervention.

- Client communication: Educating beneficiaries about the new requirements is critical. Clear notices, aligned with renewal deadlines, can reduce confusion and limit application churn. Improvements to call center capacity and online chat should be prioritized as a resource to address concerns.

- Technology upgrades: Enhancing system logic for processing renewals, managing document submissions, and automating correspondence will be vital for maintaining timeliness and accuracy.

- Maintaining eligibility: A significant challenge will be to help beneficiaries maintain Medicaid eligibility and avoid the churn of repeated application closing, which has the potential to lead to a significant increase in the uninsured population.

The transition to 6-month renewals will require strategic planning, business process analysis, robust stakeholder communication, and a commitment to operational efficiency.

-

Federal funding reductions

Over the next decade, H.R. 1 will reduce federal healthcare spending by $793 billion. For expansion states where Medicaid serves a substantial portion of the population, these cuts pose significant fiscal challenges. States must prepare for reductions in provider tax revenues, state directed payments (SDPs), and disproportionate share hospital (DSH) allotments, all of which are critical funding streams.

To address reductions, states will need to assess and redress where they can.

- Provider tax adjustments: Developing alternative funding strategies will be crucial. States must phase down existing provider taxes and review the compliance risks associated with these changes.

- Hospital revenue shortfalls: Reductions in SDPs and DSH payments will disproportionately affect rural and safety-net hospitals. States must evaluate how to support these facilities to maintain healthcare access for underserved communities.

- Strategic planning: States should explore opportunities to leverage federal grants, such as the Rural Health Transformation Program, to offset funding reductions and invest in innovative solutions.

- Alternative payment models: Developing value-based care models and pursuing efficiencies in service delivery can help states adapt to constrained budgets while maintaining quality care.

Navigating these fiscal pressures will require Medicaid programs to adopt forward-thinking strategies that balance financial sustainability with the needs of their communities.

Preparedness and innovation clear a path to turn challenges into opportunities

An important outcome to keep in mind with H.R. 1’s effect on state Medicaid programs is the opportunity to lean into innovation and transformation. By adopting proactive strategies, states can not only achieve compliance but also improve efficiency for beneficiaries.

Collaboration will be a vital component of success as states face H.R. 1 complexities—working with partners across federal agencies, workforce systems, community organizations, and healthcare providers. States must also prioritize technology investments, operational improvements, and stakeholder engagement.

CAI is prepared to help Medicaid programs meet these operational and funding challenges by:

- Maximizing system capacity for automation

- Integrating services across human service agencies

- Utilizing all available partner data to streamline eligibility determinations, verify work search activities, and minimize churn

- Simplifying eligibility determinations, enrollment workflows, and provider access

- Advocating for 1115 Medicaid Waivers to gain state flexibility to test new models for delivering services more effectively

- Maximizing braided funding models that combine federal and philanthropic dollars or public/private partnerships to sustain programs

The road ahead will not be without obstacles, but with the right strategies in place, Medicaid programs can turn these challenges into opportunities to strengthen their systems and improve the lives of the people they serve.

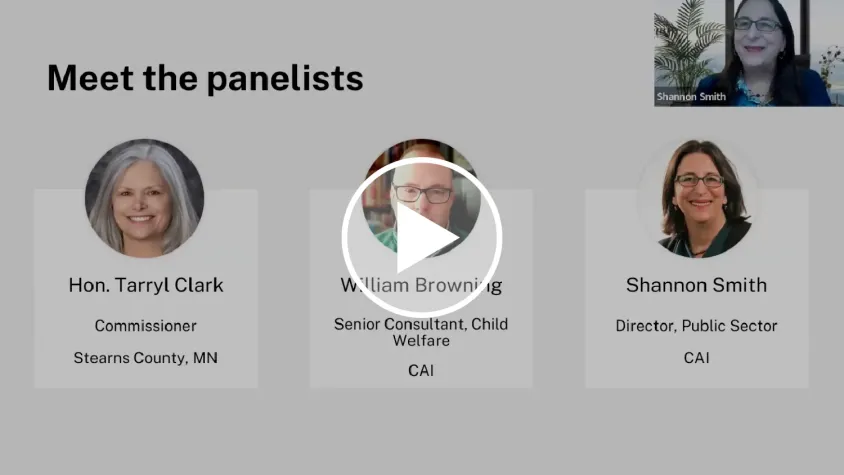

Want to learn more about how CAI has helped health and human services agencies implement changes to comply with federal mandates? Complete the form below to gain access to our experts.