How AI agents and blockchain can transform public sector finance

In the ever-evolving world of technology, tools like artificial intelligence (AI) and blockchain have emerged as driving forces for innovation. Since their arrival on the tech scene, both have contributed to reshaping industry practices.

For public sector finance leaders, this potential for advancement and innovation offers a unique opportunity. These technologies can alleviate the longstanding challenges of public sector finance —fragmented systems, fraud risk, and delayed audits—while creating a more efficient and resilient financial ecosystem.

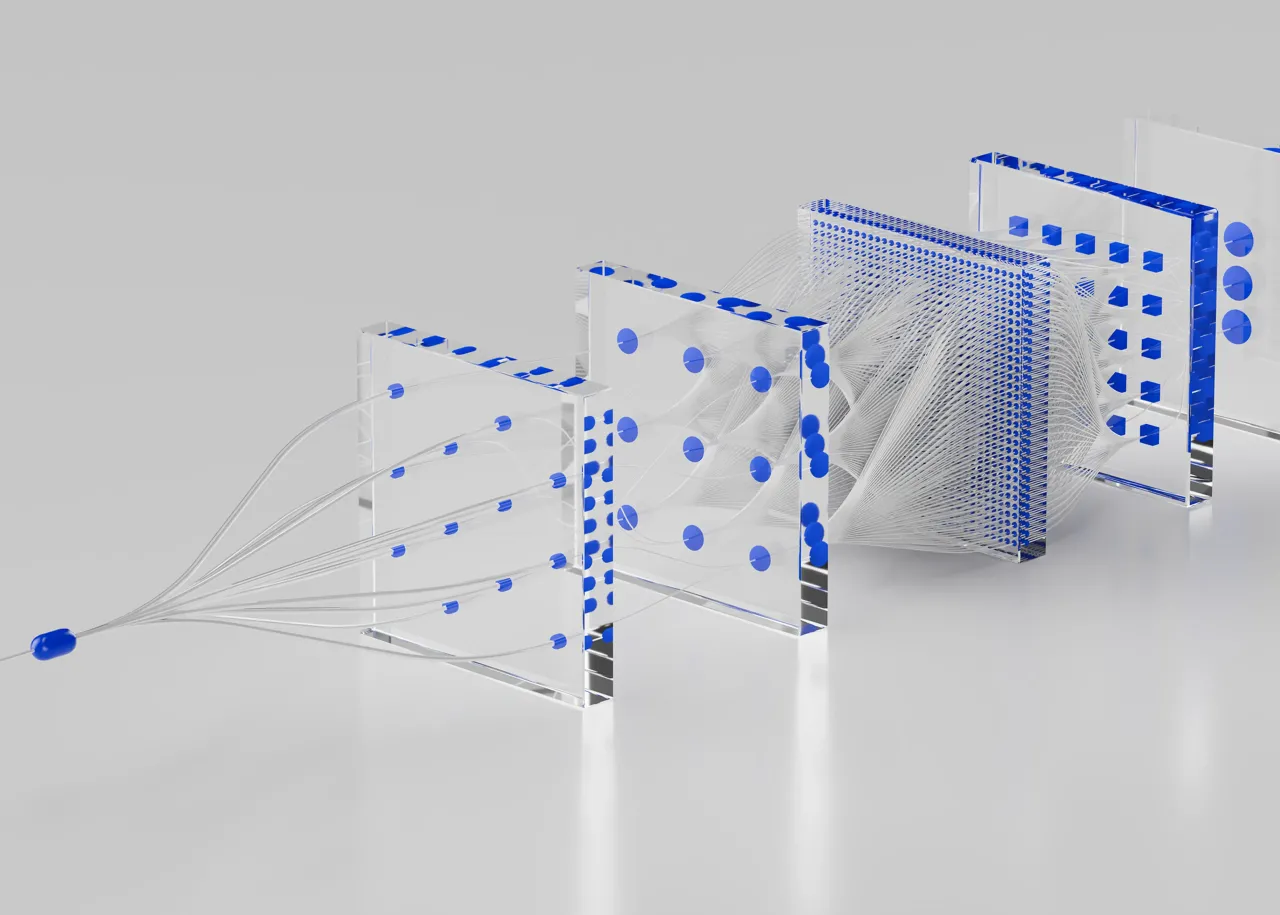

As part of the evolution of AI, AI agents are emerging as a cornerstone of intelligent automation and decision-making. These autonomous systems can perceive their environment, process information, and take actions to achieve specific goals—often without human intervention. Coupled with blockchain, these 2 technologies create a powerful synergy that can extend beyond the singular capabilities of each. Together, AI agents and blockchain offer public sector finance leaders the tools to address inefficiencies, improve transparency and resilience, and future-proof their operations.

The challenging landscape of public sector finance

Public sector finance leaders often grapple with complicated and interwoven issues that traditional tools fail to address. Fragmented systems and siloed environments hinder transparency, creating inefficiencies in workflows and compliance processes. Enterprise resource planning (ERP) platforms and business intelligence (BI) dashboards can only do so much. While helpful, they rely on centralized architectures that can be prone to manual reconciliation, delayed reporting, and data manipulation.

Fraud prevention and risk management add another layer of complexity. Without real-time access to tamper-proof data, agencies face a heightened risk of financial irregularities. Additionally, collaboration across departments or public sector agencies often involves cumbersome processes, limiting the ability to coordinate funding securely and efficiently. These challenges demand more than incremental solutions; they require a reimagined approach to public sector finance.

AI agents in finance

Unlike traditional programs that are limited to predefined rules, AI agents can learn, adapt, and operate autonomously. They consist of components like sensors (to gather data), reasoning engines (to process information and make decisions), and actuators and interfaces (to perform actions or communicate results). These agents are often found in the form of customer service chatbots, handling routine inquiries and service desk tickets. In finance, AI agents monitor markets and execute trades based on real-time data.

For the public sector, AI agents can automate compliance checks, validate budgets, and execute smart contracts for conditional payments. Their ability to process large amounts of information quickly and accurately makes them ideal for financial workflows, where speed, precision, and accountability are paramount.

How AI agents and blockchain work together

Together, AI agents and blockchain create a potent solution. Blockchain technology enhances the capabilities of AI agents by providing a foundation for trust and transparency. As a decentralized, tamper-proof ledger, blockchain records every transaction, decision, or action taken by an AI agent in an immutable format. This ensures that stakeholders, whether internal auditors or external regulators, can verify the fairness, accuracy, and compliance of the AI-driven decisions.

For multi-agent systems, blockchain facilitates decentralized coordination. AI agents can securely exchange data and verify identities without relying on a central authority, which reduces the risk of single points of failure. This infrastructure is particularly valuable for applications like decentralized finance (DeFi) autonomous logistics, and distributed energy grids.

Blockchain also strengthens data integrity, a critical component for AI agents that rely on accurate information. By validating the provenance of data inputs and ensuring their authenticity, blockchain protects against malicious actors who might manipulate training or inference data. In scenarios like fraud detection, identity verification, or AI-driven voting systems, data trustworthiness is non-negotiable, and blockchain delivers.

The synergy between blockchain and AI agents in finance

For public sector finance leaders, the integration of AI agents with blockchain technology is a game-changer. Together, they address critical challenges while unlocking 3 new opportunities for efficiency and innovation.

- Enhanced transparency and real-time audits: Blockchain ensures every transaction and AI-driven action is permanently recorded. This enables instant audits and eliminates the possibility of data manipulation. With AI agents automating compliance checks and budget validations, public sector agencies can gain proactive, tamper-proof oversight for their financial activities.

- Streamlined workflows and secure collaboration: AI agents analyze live financial data to detect anomalies, forecast budgets, and execute smart contracts for conditional payments. Blockchain guarantees the integrity of this data while enabling secure, decentralized collaboration across departments or agencies. This eliminates reliance on centralized systems and reduces operational risks, improving accountability and constituent trust at every step.

- Resilient risk management: By combining AI’s predictive capabilities with blockchain’s security, public sector finance leaders can strengthen fraud prevention and risk management. AI agents flag suspicious patterns in real time, while blockchain ensures the data driving these insights remains untouched. This integration transforms financial workflows from reactive to proactive, enabling leaders to address issues before they escalate.

Beyond automation, AI agents are also being integrated into multi-agent systems, where multiple agents collaborate or compete to solve complex problems. This is especially useful in logistics, smart grids, and simulations of social or economic systems. As AI continues to evolve, agents are becoming more context-aware, capable of reasoning about human intentions, and even interacting with other AI systems. This opens up possibilities for more dynamic, intelligent ecosystems where AI agents act as digital collaborators, not just tools.

The future of AI agents, blockchain, and AI agents in finance

AI agents represent a transformative leap in how software systems interact with data, environments, and users. Their ability to learn, adapt, and act autonomously makes them ideal for a wide range of applications. As these agents become more sophisticated, their role in digital ecosystems will expand, offering new levels of efficiency, personalization, and intelligence.

When integrated with blockchain technology, AI agents gain a powerful foundation of trust, transparency, and decentralization. This synergy enables public sector finance leaders to transition from outdated, reactive workflows to proactive, intelligent systems that prioritize accountability and resilience.

Together, AI agents and blockchain are paving the way for a brighter future in public sector finance—one defined by innovation, efficiency, and trust.

To learn about how CAI works with the public sector and finance leaders, fill out the form below.